Get Your Free Report!

With just 6 key pieces of information I can write up a customised report that will tell if it’s worth refinancing your mortgage! You might need to contact your bank to get some of the info required here. Once you send off the form, I will complete your report and send it to you…

Order your free reportWe take into account your long-term financial goals, turning our focus to ensure that your mortgage structure is well-suited to enable your property portfolio to perform.

We are willing to talk directly to your nominated bank and solicitor, ensuring all required documentation is correctly completed, making the unconditional and settlement process seamless and less stressful for you. You can also contact mortgage adviser to better consultation.

Even though your bank may charge a “break fee” it still might be worth refinancing onto a lower interest rate

A question I often get is: “Is it worth refinancing my mortgage to a lower interest when I have to pay a break fee?” (A break fee is what the bank may charge you for breaking the term of a current fixed interest rate).

BOOK A CALL WITH me Clayton D’Lima – Founder, Mortgage AdviserUnsurprisingly the answer is: “It depends!”

Take the following example…

I recently advised a couple whose mortgage had a break fee of $15,400. Pretty substantial, and at first glance you might not think it would be worth refinancing.

But look at the numbers...

The current mortgage balance was $420,000, so with the break fee added to this the total was $435,400.

However, I managed to get them an offer from another bank where the new bank contributed $3,000 so, after legal fees, it left $2000 that could be applied to the loan.

The actual balance to be refinanced was now:

$420,000 + $13,400 = $433,400

By keeping the repayments the same I reduced the term from 27 years to 20.5 years. So after two years (which is when their current fixed rate would have expired) their loan balance would have been almost $2800 lower than it would have been.

In 10 years’ time, if they wanted to buy a rental property, they’d have an additional $68,724 in equity that they could access.

And the total interest saved over the course of the loan was a whopping $188,769… without increasing the repayments!

By refinancing their mortgage they made a massive difference to their future financial position, with no increase to their existing financial commitments.

Could I make the same improvement to your situation?

Well there’s only one way to find out, and that’s by crunching the numbers that you send through to me from the quick questionnaire on this page.

Not everyone’s situation is able to be improved, but you’d be surprised how often it can. At the end of the day, what have you got to lose by finding out?

What’s included in your report? In a nutshell your free report will include:

Core Logic Comparative Market Analysis Report

The CoreLogic Comparative Market Analysis Report for your property provides an up-to-date market valuation range. It provides a history of your property and what similar properties have sold for in your area. Bear in mind that the valuation range provided will probably not take into account any recent renovations you may have done.

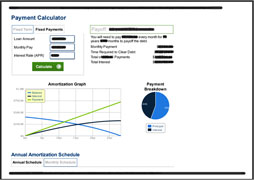

Your current mortgage repayment trajectory

This is where I crunch the numbers that you send to me and produce a comprehensive report that details exactly how your mortgage is on track to be paid off, including:

- Number of payments

- Number of years to pay off

- Proportion of interest to principal

- Total interest to be paid

If nothing else your report will clarify your current situation and leave you in no doubt about where this will lead you in the future.

Recommendation for your future mortgage repayment trajectory

Where the report in the previous section can be thought of as the “BEFORE” (or current) scenario, I produce another report in the same format that can be considered the "AFTER" scenario.

In other words, this outlines an alternative trajectory for you to consider.

If I think it’s appropriate I may run off two or more scenarios for you to compare.

And if I believe your current path makes the most sense for your financial future I may not run off any other scenarios at all and will simply say "congratulations, you're doing well!"

Meet With Our Team

Clayton D’Lima – Founder, Mortgage Adviser

Clayton founded MortgageDesign with the aim to helping Kiwis realise their dream of owning their own home. Clayton is very passionate about properties and helping others achieve their goals. He specialises in structuring the loans to suit the needs of his clients.

- :021 175 9559

- :clayton@mortgagedesign.co.nz

- :FSP480886

J.J – Financial Adviser

As a trusted adviser he always ensures his clients are well informed throughout the entire application process. He continues to work with them on an ongoing basis to review any future financial need, always putting their best interest first.

- :027 336 3000

- :jj@mortgagedesign.co.nz

- :FSP480886

Get Your Free Report!

With just 6 key pieces of information I can write up a customised report that will tell if it’s worth refinancing your mortgage! You might need to contact your bank to get some of the info required here. Once you send off the form, I will complete your report and send it to you...